Value elasticity is likely one of the most basic, important financial ideas any enterprise proprietor or gross sales skilled wants to grasp. Having a pulse on the value elasticity of your choices is central to forecasting successfully, structuring a sound pricing technique, and constructing a responsive, profitable firm.

However what’s value elasticity? How do you calculate it? What are the various kinds of value elasticity? And what do they imply for your corporation? Right here, we’ll reply all of these questions and extra. Let’s dive in.

Learn how to Calculate Value Elasticity

Value Elasticity of Demand System

Kinds of Value Elasticity of Demand

Value Elasticity of Provide System

What’s value elasticity?

Earlier than we break issues down, let’s start by degree setting on value elasticity on the whole. Value elasticity measures how delicate the demand and provide of your product are to adjustments in value. For instance, the value elasticity of demand measures many purchasers will proceed to buy your services or products when you improve the value.

Value elasticity can fall into considered one of three buckets:

- Value elastic — the place value adjustments significantly have an effect on the availability or demand of a services or products.

- Value inelastic — the place provide and demand will work inversely (a.okay.a. in the other way) to cost adjustments.

- Value unit elastic — the place a value change is proportional to the change in provide and demand they usually transfer on the similar fee.

Now that we’ve a really feel for what value elasticity is, let’s check out the best way to calculate it.

Learn how to Calculate Value Elasticity

To calculate value elasticity, divide the change in demand (or provide) for a product, service, useful resource, or commodity by its change in value. That determine will let you know which bucket your product falls into.

- A worth of 1 signifies that your product is unit elastic and adjustments in your value replicate an equal change in provide or demand.

- A worth of >1 signifies that your product is elastic and adjustments in your value will trigger a better than proportional change in provide or demand.

- A worth of <1 signifies that your product is inelastic and adjustments in your value will end in a smaller change within the provide or demand in your product.

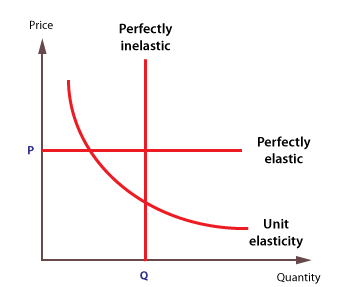

For example these economics, right here’s a chart that reveals all three buckets:

How will you apply value elasticity?

Value elasticity offers you some helpful data on the best way to finest value your services and products.

In case you have an elastic product, then try to be cautious about elevating costs since a value improve will significantly impression purchases (demand) and manufacturing (provide). But when your providing is value inelastic, then you possibly can regulate your costs with much less warning since you realize that the change can have a smaller impression on provide and demand.

Now that we’ve lined how value elasticity impacts your corporation, let’s break issues down even additional.

Value Elasticity of Demand

The method under (often known as PED) is used to establish how a change in value impacts the availability or demand of an providing or commodity. If folks nonetheless purchase a product, service, or useful resource when the value is raised, that providing is inelastic. An providing is elastic when demand suffers resulting from value fluctuations.

For instance, analysis reveals that elevating cigarette costs doesn’t do a lot to cease people who smoke from shopping for cigarettes — making cigarettes an inelastic commodity. Cable tv, nevertheless, is a really elastic product. As the value of cable has elevated, demand has decreased as extra customers “lower the twine.”

Substitutions like Netflix, Hulu, and different streaming providers have made the cable business elastic. There are additionally substitutions for Tobacco (together with options like vaporizers and nicotine patches), however none have affected their core shopper’s need and talent to proceed shopping for cigarettes.

Value Elasticity of Demand System

% Change in Amount / % Change in Value = Value Elasticity of Demand

Should you promote 10,000 reams of paper at $100 per ream after which increase the value to $150 per ream and promote 7,000 reams, your elasticity of demand could be -0.88. This could be thought-about inelastic as a result of it’s lower than one.

Damaged down even additional to incorporate the calculation of % change, this method appears like:

((QN – QI) / (QN + QI) / 2) / ((PN – PI) / (PN + PI) / 2)

- QN = New amount (7,000)

- QI = Preliminary amount (10,000)

- PN = New value ($150)

- PI = Preliminary value ($100)

Our numbers plugged into this method could be:

(7,000 – 10,000) / (7,000 +10,000) /2) / (150 – 100) / (150 – 100) / 2)

Head spinning? Take a look at this free calculator.

This method is useful in figuring out if a services or products is value delicate. Ideally, you need your providing to be essential (inelastic) that customers take into account non-negotiable throughout value fluctuation, not a nice-to-have (elastic).

Kinds of Value Elasticity of Demand

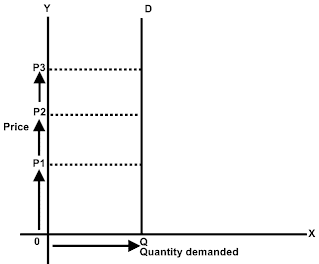

1. Completely Inelastic Demand

In case your PED equals 0, value adjustments don’t have an effect on your product’s demand. Typically talking, solely completely important gadgets and providers have completely inelastic demand. Only a few — if any — services or products like that exist, making completely inelastic demand a principally hypothetical idea.

As an illustration, if there have been a life-saving drug in the marketplace that individuals would pay any value to acquire, demand would stay the identical regardless of how a lot the value would possibly rise.

2. Comparatively Inelastic Demand

If the % change for demand is lower than the % change of the product’s value. Mandatory items and providers that individuals could be keen to pay extra for have comparatively elastic demand — most often.

This usually contains items or assets with no shut substitutes like electrical energy — a near-essential useful resource with none viable various. Dropping entry to it might have large implications in your each day life, and also you’d have nowhere else to show when that occurred.

For essentially the most half, folks could be keen to cowl any value will increase to maintain their energy on. That stated, electrical energy is not as vital as a life-saving drug, so some folks could be keen to go with out it if the value have been too steep — making demand for it comparatively inelastic.

3. Unit Elastic Demand

If the change in demand for a services or products yields a proportional change in value — that means a value increase of X% results in an X% lower in demand — the providing in query has unit elastic demand.

Such a value elasticity of demand is only hypothetical. There are not any precise examples of unit elastic demand in follow. Demand is rarely fully linear. Although there’s clearly a direct relationship between value and demand, that relationship is rarely squarely one-to-one.

If a model have been to barely increase its costs, it might nonetheless seemingly have customers preferring it to its options sufficient to proceed to purchase its services or products — so a ten% increase in value would not imply precisely 10% of current prospects routinely flip to that firm’s opponents.

In an analogous vein, a particularly radical value hike for a nonessential services or products would possibly flip off a disproportionately excessive variety of prospects, relative to the share change in costs. If a model determined to boost costs 40% with out warning — greater than 40% of its current prospects would possibly leap ship.

4. Comparatively Elastic Demand

If demand change is bigger than the change in your product’s value. Right here, a comparatively small change in value will make for a really giant change in demand. Comparatively elastic demand is often related to gadgets which have a number of substitutes.

As an illustration, for example there’s an electronics producer that sells 40-inch good TVs for $250. All of its opponents promote comparable merchandise for a similar value — and people opponents’ TVs have nearly indistinguishable decision and options from the producer in query.

If the producer have been to boost its value from $250 to $275, customers would seemingly be much less inclined to pay an extra $25 for a product that is so essentially much like its barely cheaper competitors — and demand for the producer’s TV would drop pretty radically, making its demand comparatively elastic.

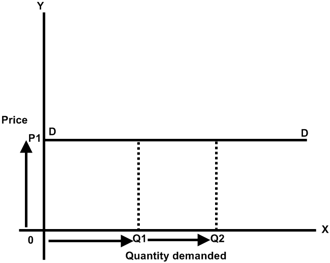

5. Completely Elastic Demand

If demand falls to zero on the slightest value improve or demand turns into nice with a slight value lower. Completely elastic demand demonstrates that the demand for a product is 100% immediately tied to its value.

Like unit elastic demand, there are not any precise examples of completely elastic demand in follow. Demand for a services or products is rarely linear sufficient to make any change in value immediate an absolute drop in demand.

There’ll all the time be some individuals who have preferences which can be usually unshaken by slight value adjustments. If the value of a bottle of Sprite was to extend by $1, there’ll nonetheless be customers keen to pay extra for it over options like Sierra Mist or 7Up.

Whereas some choices have notably price-sensitive buyer bases, there are no that customers will completely abandon as quickly as that good prices even one cent greater than it did earlier than.

Value Elasticity of Provide

The value elasticity of provide (PES) measures how responsive the availability of a services or products is when there’s a change in value.

If provide is inelastic, it’d imply an organization is simply too short-staffed to maintain up with demand, wants an extended lead time to supply extra of its product, or does not have the assets to broaden its services.

If provide is elastic, an organization might need a surplus of obtainable workers to extend provide. Realizing PES permits companies to find out whether or not a change in value will negatively or positively have an effect on the demand for its services or products.

Value Elasticity of Provide System

Value Elasticity of Provide = % change of provide / % change in value

If provide is inelastic, a rise in value results in a change in provide that is lower than the rise in value, that means the PES is lower than one. If provide is elastic, the value change yields a bigger improve in provide making the PES better than one.

For instance, if the value of “World’s Best Boss” mugs falls 10% and the availability falls 5%, the PES is .5 and regarded inelastic. If the value of bobbleheads will increase by 15% and provide will increase by 20%, the value elasticity of provide (PES) is 1.3 and elastic.

Cross Value Elasticity

Cross value elasticity of demand measures how responsive the demand for a services or products is when the value for one more services or products adjustments. For instance, if Hulu with Stay TV raises its costs to $45 per thirty days, will prospects go away the service for YouTube TV — an analogous streaming service charging solely $40 per thirty days?

As the value of Hulu Stay rises, the demand for its competitor’s service rises. Inside cross value elasticity, YouTube could be thought-about a “substitute good.”

If, nevertheless, the price of televisions elevated and the variety of prospects utilizing subscription providers like Hulu or YouTube decreased due to the value improve of televisions, this might be known as “complementary items.”

Cross value elasticity permits companies to value their services or products competitively, plan for dangers, and map their market. In case your services or products has no actual competitor, you needn’t take into account cross value elasticity as a result of there is no such thing as a substitute in your providing. Nonetheless, if a complementary services or products sees a market fluctuation, you would possibly want to arrange for cross value elasticity.

Cross Value Elasticity System

Cross Value Elasticity of Demand = % change in amount demanded for Product A / % change Product B’s value

Your services or products’s value elasticity can inform your pricing technique, assist you really feel out your aggressive benefit, and in the end dictate how your organization plans for the long run. Given the huge implications it may have on your corporation, having a grip on value elasticity — as an idea — is in your finest curiosity.

Editor’s observe: This publish was initially printed in April 3, 2019 and has been up to date for comprehensiveness.