For many youthful shoppers, the rising price of dwelling represents the primary expertise of a difficult financial setting. Already, 1 / 4 of 18-24 yr olds say they’re uncomfortable with their debt ranges, whereas greater than 4 in ten of this age group count on their debt ranges to extend over the following yr. With much less monetary expertise than older demographics, younger folks will want help from monetary suppliers. On this weblog, we discover 3 methods manufacturers might help younger shoppers handle their funds throughout the price of dwelling disaster.

1. Assist younger shoppers perceive credit score merchandise

The marketplace for credit score merchandise is rising as folks look to navigate the price of dwelling disaster. Younger shoppers’ funds aren’t any exception, with 64% of 18-24 yr olds having unsecured money owed similar to bank cards, overdrafts and loans. With much less monetary expertise, it will be important for banks to offer clear steering for younger clients. Already greater than three in ten of below 25s say they’ve been rejected for credit score merchandise within the final yr, doubtlessly impacting credit score rankings.

It’s vital banks present shoppers their odds of being accredited for credit score merchandise to assist determination making with none detrimental impression on credit score scores. There may be sturdy demand for such companies, with 45% of below 25s saying they’d fortunately share their monetary information to see their possibilities of approval. There may be additionally scope for credit score rating checking performance to be expanded. We’ve got seen NatWest accomplice with TransUnion to supply clients free credit score rating checks in-app, with steering on how potential credit score functions would impression the rating and ideas to enhance it.

Banks must also look to spice up monetary training amongst younger Brits. This might embrace dwell streams and video content material accessible in-app or by way of social media, offering steering on understanding and bettering credit score rankings, alongside budgeting recommendation and clear hyperlinks to debt recommendation companies. At present the usage of debt recommendation instruments and companies is extraordinarily fragmented, and searching for assist might show overwhelming for younger shoppers with out steering from banks. If the price of dwelling disaster persists, this steering can be very important, with 43% of below 25s with money owed saying they’ve missed a compensation within the final 12 months.

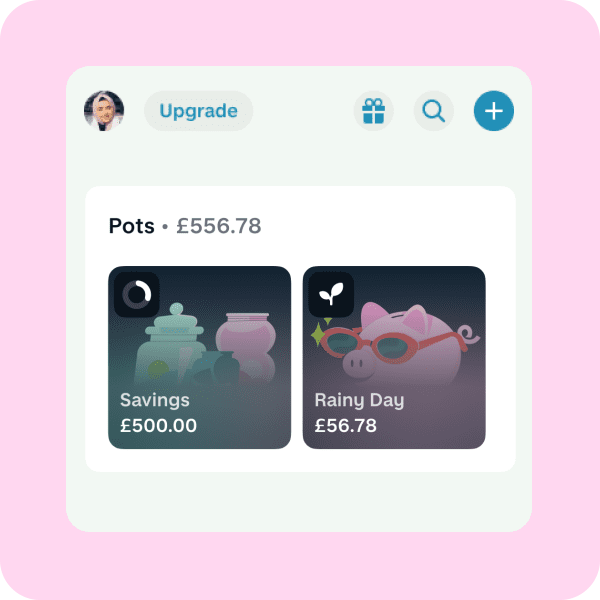

2. Supply modern, app-based budgeting and monetary companies merchandise

Cell banking platforms have more and more provided budgeting instruments and this has grown in significance by the price of dwelling disaster. There stays room for enchancment and this can be key in partaking younger shoppers. Mintel’s newest analysis finds that greater than half of below 25s with a number of accounts say they use extra accounts because the cell app is superior to that of their foremost account supplier. If retail banks can’t innovate, they danger youthful clients shifting their foremost financial institution accounts to digital banks similar to Monzo or Chase. Alongside modern budgeting instruments, elevating consciousness of Open Banking expertise can be necessary. Almost seven in ten monetary app customers below 25 would like to see all their monetary merchandise in a single app. This makes the principle checking account the best hub for serving to tech-savvy younger clients acquire an in depth image of their funds.

The widespread use of apps by youthful shoppers additionally supplies a possibility for monetary companies to spice up engagement with demographics they’ve struggled to draw previously. Particularly, areas similar to insurance coverage and investments might considerably enhance their enchantment by focusing extra on app-based accounts. This might be by cell banking apps and partnerships with digital banks, hyperlinks to third-party aggregators or standalone model apps. The secret is simplifying the method of opening accounts, accessing product info and evaluating costs.

This might additionally drive innovation in industries which have historically been gradual to alter. We’ve got seen the launch of US insurance coverage FinTech Lemonade in partnership with Aviva and there’s room to disrupt the market additional. Simply 6% of finance app customers below 35 have used an insurance coverage app within the final yr, with comparable low ranges of utilization for funding apps, which highlights the necessity to enhance engagement.

3. Tailor credit score merchandise and accounts to youthful life

Almost a fifth of individuals below 25 say they owe cash on a present account overdraft facility, in contrast with simply 8% of the over 55s. This displays weakerf financial savings and monetary resilience amongst youthful shoppers. Many can be on the lookout for extra types of credit score as the price of dwelling disaster progresses they usually run out of cutbacks. Regardless of excessive rates of interest, overdrafts characterize a handy, extensively accessible type of credit score for younger folks. Providing engaging curiosity free buffers might show a significant draw in relation to selecting new accounts for switching.

In recent times, money becoming a member of incentives have pushed switching exercise. Nevertheless, offers similar to HSBC’s restricted time £500 curiosity free overdraft for 12 months might show attractive.

There’s a want for financial institution accounts and credit score merchandise to be tailor-made in direction of youthful life. Together with low or curiosity free overdrafts for youthful folks throughout the troublesome financial setting might assist enhance loyalty and create lifelong clients. Some banks, similar to NatWest and Monzo, have additionally built-in purchase now, pay later (BNPL) companies into their accounts. There may be additionally scope to supply account add-ons similar to smartphone insurance coverage and contents insurance coverage for rented and shared lodging. In the meantime, bank cards ought to prioritise constructing credit score historical past and rewards that embrace discounted tickets to occasions similar to festivals. If web price financial savings might be demonstrated, this might assist enhance possession of fee-paying accounts amongst youthful folks.

What we expect

It is usually necessary that banks don’t forget the significance of face-to-face help for younger clients. Branches have persistently closed lately as footfall declines and other people shift in direction of digital communications. Regardless of this, practically two thirds of below 25s say they like monetary suppliers which have a bodily department and 58% of this age group say the rising price of dwelling has inspired them to speak to monetary suppliers face-to-face.

Branches can supply reassurance and amongst these with much less monetary expertise, face-to-face steering should stay an choice. As younger folks face rising monetary stress, banks ought to improve availability and consciousness of video chat appointments and be proactive in making certain younger clients are receiving the help they want throughout the price of dwelling disaster.

To get extra insights signal as much as Mintel’s free E-newsletter ‘Highlight’ right here;

Mintel purchasers can entry this report right here.