Incomation fails to offer possession or government data on its web site.

Incomation fails to offer possession or government data on its web site.

Incomation operates from a subdomain hosted on Kartra (“incomation.katra.com”).

Kartra markets itself as “the best all-in-one platform ever”. Kartra is a part of Genesis Digital LLC, a US firm run by CEO Sarah Jenkins.

So far as I can inform, whoever is working Incomation is a consumer of Kartra’s – there’s in any other case no direct connection between the 2 corporations.

On the backside of Incomation’s web site are a sequence of hyperlinks below the heading “Join with our Founder”.

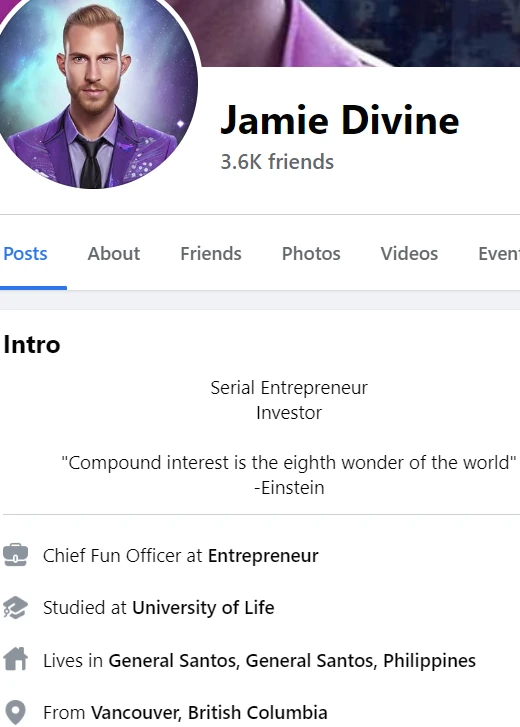

These hyperlinks result in numerous social media profiles of Jamie Divine.

In accordance with his FaceBook profile, Divine is a Canadian nationwide dwelling within the Philippines.

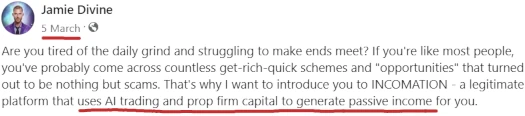

Earlier than he launched Incomation, Divine was an Eaconomy promoter.

Eaconomy launched in 2019. The corporate happened after Hassan Mahmoud and spouse Candace break up from convicted fraudster David Mayer.

Earlier than Eaconomy the Mahmouds and Mayer ran Silver Star Stay. Each Silver Star Stay and Eaconomy had been MLM corporations constructed round an AI foreign currency trading bot.

The Mahmouds settled Silver Star Stay commodities fraud prices with the CFTC in 2019. In 2021 the CFTC secured a $15.6 million judgment in opposition to David Mayer, once more for Silver Star Stay commodities fraud.

Eaconomy collapsed in 2020. In 2021 there was a transient Eaconomy reboot via Jeremy Reynolds’ Past.

That lasted a couple of months earlier than Past itself collapsed and was offered off to My Every day Selection.

In early 2021 Eaconomy was rebooted for a a third-time, with the identical AI foreign currency trading bot ruse.

Eaconomy’s web site remains to be up as of April 2023 however there’s not a lot happening.

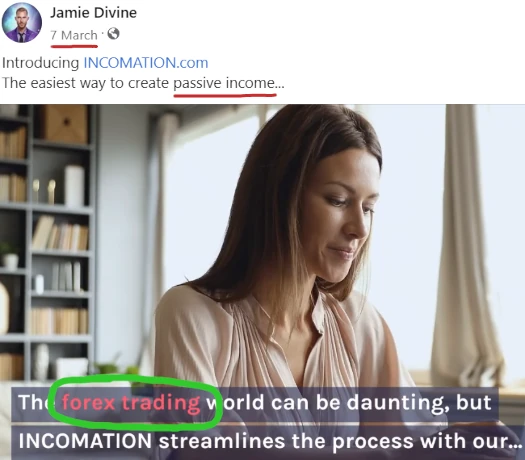

Right here’s a quote from Jamie Divine as he was launching Incomation;

Are you finished with build up tasks simply to have them crash and burn?

Are you bored with corporations that don’t have your greatest pursuits at coronary heart?

Sick of getting used on your networks after which left within the mud?

Are you fed up with over-promising and under-delivering?

Properly, I’ve some thrilling information for you!

We’re introducing a revolutionary new AI buying and selling system that leverages prop agency funds, however with a coronary heart for the purchasers AND associates.

I do know that was a variety of backstory to get again to Incomation. I’ll go over why I took the time to cowl Eaconomy’s origins in-depth within the conclusion of this evaluation.

Learn on for a full evaluation of Incomation’s MLM alternative.

Incomation’s Merchandise

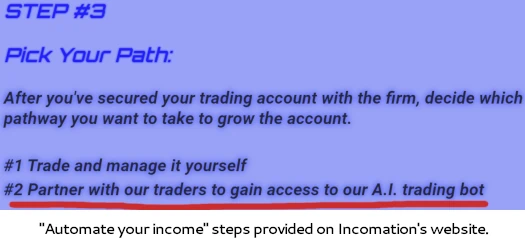

Incomation markets passive returns via an “A.I. buying and selling bot”.

Entry to the bot prices $1500 for a $100,000 funded account, or $2000 for a $200,000 funded account.

Funded accounts are primarily offered by Subsequent Step Funded, with Incomation representing Subsequent Step Funded will eat any losses.

Am I accountable for any losses on the account?

No, the losses are fully coated by the prop agency which is why they’ve such strict necessities to move their challenges and keep the accounts.

We’ll go over Subsequent Step Funded a bit extra within the conclusion of this evaluation.

Incomation’s Compensation Plan

Incomation associates are paid on the recruitment of retail clients and associates who make investments $1500 or $2000.

Referral Commissions

Incomation pays a referral fee on funds invested down two ranges of recruitment (unilevel):

- stage 1 (personally recruited associates) – 20%

- stage 2 – 10%

It is a one-time fee tied to preliminary funding.

ROI Commissions

Incomation pays a fee on passive returns earned down two ranges of recruitment:

- stage 1 – 20%

- stage 2 – 10%

It is a month-to-month recurring fee, tied to passive returns paid out every month.

Becoming a member of Incomation

Incomation affiliate membership is tied to a $1500 or $2000 funding.

The extra an Incomation affiliate invests the upper their revenue potential.

Incomation Conclusion

Incomation sells entry to $100,000 and $200,000 foreign currency trading accounts for $1500 and $2000 respectively.

Topic to some “challenges”, apparently there’s a agency prepared to let folks blow up lots of of 1000’s of {dollars} for a tiny outlay.

Do I must level out that is an completely silly enterprise mannequin that is senseless in the actual world?

Subsequent Step Funded offers no possession, government or regulatory data on its web site.

Subsequent Step Funded’s web site area (“nextstepfunded.com”), was solely just lately privately registered on October ninth, 2022.

And there’s this, from Subsequent Step Funded’s web site phrases and circumstances:

These Phrases are ruled by the legal guidelines of Saint Vincent and the Grenadines and every occasion irrevocably and unconditionally submits to the non-exclusive jurisdiction of the courts of Saint Vincent and the Grenadines.

St. Vincent and the Grenadines is a tax haven with no energetic regulation of MLM associated fraud.

I additionally famous referenced to MDP Funding, which seems to be one other funded buying and selling account possibility.

MDP Funding is one other firm that doesn’t disclose something about itself, apart from it purportedly operates via Australian shell firm Prop Commerce Tech.

Like Subsequent Step Funded, MDP Funding’s web site area (“mdpfunding.com”), was solely just lately privately registered on December eleventh, 2022.

These are your first crimson flags in the case of Incomation.

Having been an Eaconomy promoter, Incomation is simply Jamie Divine copy and pasting the identical A.I. buying and selling bot mannequin.

The issue with each buying and selling bot MLM scheme is that if the bot truly labored long-term, there’d be no want for an hooked up MLM scheme.

Simply run the bot, rake in infinity cash and turn out to be one of many richest folks on the planet.

On the regulatory entrance Incomation fails to reveal any details about its purported A.I. buying and selling bot. With respect to regulatory licenses, the 2 at play listed here are securities and commodities.

Securities regulation covers any MLM firm providing a passive funding alternative. That is regardless of how the funding alternative is run or the medium (USD, cryptocurrency and so forth.).

Commodities legal guidelines kick in attributable to Incomation representing passive returns are derived through foreign currency trading.

Within the US, Incomation must be registered with the CFTC and SEC. Neither Incomation or Jamie Devine are registered with both regulator.

Subsequent Step Funded doesn’t look like registered with any monetary regulators both.

I did be aware this from Subsequent Step Funded’s web site FAQ;

Which Platforms Can I Use for My Buying and selling?

You might be permitted to commerce your account with the MT4 platform which is offered by ASIC-regulated dealer EightCap.

That is irrelevant. Incomation and Subsequent Step Funded are each required to be registered with securities and commodities regulators in each jurisdiction they solicit funding in.

Sadly Incomation’s web site doesn’t obtain sufficient visitors for SimilarWeb to offer a geographical breakdown.

What I can present you although is relevant regulators for admins of Incomation’s official FaceBook group:

- Jamie Divine – resident of Philippines, securities and commodities regulated by Philippine SEC

- Anfa Pleasure Samboa – seems to be resident of Philippines, securities and commodities regulated by Philippine SEC

- Will J. Galindez – resident of Illinois within the US, securities regulated by SEC and commodities regulated by CFTC

- Nicholas V. LoScalzo – resident of Kansas within the US, securities regulated by SEC and commodities regulated by CFTC

- Ollie Grey, resident of Worcestershire within the UK, securities and commodities regulated by FCA

None of those people look like registered with the relevant monetary regulators.

What tends to occur in these dodgy buying and selling bot schemes is the accounts inevitably blow up. Subsequent Step Funded being round since late 2022 with nameless possession is testomony to that.

With respect to losses, any cash paid to Incomation is gone the second it’s handed over.

That is from Subsequent Step Funded’s web site FAQ;

Do you provide refunds?

If you’re buying an analysis via Subsequent Step Funded you’re doing so in acknowledgement that you’ll not be refunded.

You’re mainly hoping to get better your charges via the A.I. buying and selling bot earlier than the account blows up or Subsequent Step Funded disappears.

Incomation’s regulatory shortcomings are purpose sufficient to remain well-clear.

Look no additional than Eaconomy for the inspiration behind Incomation, together with proof that, even after 4 years, no person has made long-term constant cash via buying and selling.